By Mark Corker

09/29/2020

If you’re running your business on Microsoft Dynamics AX, the end of support is here:

Without system support, your business won’t receive critical security updates or bug fixes. When your business system runs into problems, your entire operation could face a costly shutdown.

Microsoft is pressuring you to move to a new product – Dynamics 365 Finance and Operations (F&O). This upgrade is complex, costly, and will take 12 months or longer to implement.

What are your options? In this series, we’ll recap how AX users ended up here and outline your alternatives.

My Background: From Microsoft fan, to partner, to competition

I started my engineering career on the shop floor at Black and Decker, learning about operational excellence, lean, and productivity optimization. I’ve owned and served on the board of multiple manufacturing companies. I made the jump to manufacturing technology and founded an ERP company in 1992.

Since the early days, I’ve been a big fan of Microsoft. My team currently uses all kinds of great Microsoft products like SQL Server, .Net Framework, Microsoft Office, Exchange, and Windows 10. Our products use more mainstream Microsoft technology than Dynamics does, and our solution was the first product to achieve Gold ERP Certification on SQL Server.

I’ve been partnering, integrating, reselling, and competing with Microsoft since the 1990s. Although I’m currently not a partner, I am very familiar with all of the Dynamics ERP products because our customers have used them all, so we’ve had to integrate every Dynamics product. Even though it would be a stretch to say we’re a serious Dynamics competitor, we have enjoyed modest success in our targeted manufacturing verticals.

As a founder of an ERP software company, I wear many hats, and I’m involved in everything from software development, technology platforms, and sales. Plus, like most small organizations, we have a short line of sight between product development and customer perceived value. I’m out visiting 2 or 3 factories a week, talking to owners, end-users, and thought leaders about how they use their ERP systems. I also have relationships with many competitors.

Plus, I’ve directly participated in many technical and commercial facets of Microsoft’s ERP business. I’ve had detailed exposure to their technical platforms, functional capabilities, and customer and partner experiences. All of these combined experiences have provided me with a unique view of Microsoft’s ERP Product management to where I can assess their actions and strategies in depth.

In this series, I’ll focus on Dynamics AX. Many AX customers need to make some urgent and difficult decisions because they will soon run out of support. I’ll analyze the predicament that Microsoft’s upgrade path creates for AX customers.

First, let’s take a quick trip back in time to explain how AX customers ended up the creek.

Launching into the ERP Market: Microsoft Acquires Axapta

I’ll try to keep this short as I can, but there’s a lot of ground to cover. In 2002, Microsoft stormed into the mid-market ERP space spending $2.5 billion on two acquisitions. First, they acquired Navision, who also owned the Axapta product, and shortly after that, they acquired Great Plains, who also owned the Solomon product. Then they folded everything into a new business unit called Microsoft Business Solutions. Ultimately the individual ERP products would be rebranded as Dynamics AX, Dynamics GP, Dynamics NV, and Dynamics SL. I’ll use Axapta and Dynamics AX interchangeably.

Microsoft had previously leveraged its successes with Windows and Office to dominate adjacent markets, including Web Browsers, Server Operating Systems, and Email products. No one doubted that they would replicate this strategy to conquer the mid-market ERP space.

However, Microsoft needed to address a few challenges before world domination. The acquired ERP products were an incompatible patchwork. They were built with aging, proprietary, and fringe technologies, including in Axapta’s case the X++ framework. None of the products used mainstream Microsoft development tools.

2003 – The Windows of ERP?: Enter Project Green

In 2003 Microsoft released a minor update – Axapta Version 3.0. While this release included a few minor functional improvements, they directed the bulk of development effort into expanding integration (and monetization) to other Microsoft products. In this case, Office and SharePoint. This strategy was Microsoft’s modus operandi and would be a recurring theme for every future release.

But that wasn’t the big news. The headline was the announcement of Project Green. Project Green would modernize the disjointed jumble of ERP technologies with a complete rewrite. Microsoft would create a showcase project based on its latest development platform. Massive software projects like this were Microsoft’s bread and butter, and few doubted the certainty that they would take over the SMB ERP market.

Project Green was a massive undertaking. Microsoft set a 2005 release date and began pouring enormous resources into the project. They threw thousands of employees from around the globe into the exciting task of creating a fantastic, modern ERP system.

So far, so good. There’s an industry-wide buzz. Customers are excited, resellers are thrilled, and competitors are worried. The media eats it all up. Manufacturers set their sights on moving to this new modern platform. Project Green is the future, and it’s exciting. There are a few people voicing concerns but this new system is going to address those concerns- right? So, the majority of the market is ecstatic over the promise of this amazing new system.

In hindsight, this moment was the pinnacle for the Microsoft Dynamics brand. The next decade would be all downhill.

2004: Speculation and rumours

Eighteen months later, near the end of 2004, a few cracks begin to emerge. For resellers, new ERP sales (and the associated fat sales commissions) vanish. Customers aren’t about to write 6-figure checks to buy an aging product when its superior replacement is right around the corner.

The ERP business unit (MBS) is racking up the largest losses of any Microsoft division. The staggering $193 million loss from the second half of 2003 is followed by another $70 million in 2004 Q2. There are rumours the entire division is up for sale.

2005: Realizing the worst…

In 2005 the cracks widened. Although Microsoft starts to hedge on the release date, they are still producing slide decks outlining significant progress and beta test schedules. The messaging is that customers love it. The product is everything it was hoped it would be. Project Green just needs to wrap up a few loose ends. The release is imminent.

But the release date is pushed back again. Now it’s Q4 2005.

During this time, I’m a Microsoft Partner. I’m attending the Dynamics Business and Manufacturing Summit events. I have my own software development decisions to make. We didn’t have our own financial modules – our system integrates with Axapta, Great Plains, and Navision.

My company is getting killed in the market and losing deals left, right, and center. Our competitors spare no effort to inform our prospects that we’re using Microsoft’s obsolete financial modules. We’re getting increasingly anxious for Project Green’s release as we desperately needed the new financial modules.

I fly down to the Microsoft’s Manufacturing Summit event. I expect to get my hands on the product and integration specs. Instead, I’m only getting vague and aspirational slide decks. There aren’t any product screenshots. There are no integration specs. An Axapta customer mentions their beta test just got pushed back to 2008. I realize that Project Green was nowhere near ready to be released.

Having experienced my fair share of missed software dates, I did some rough calculations. Extrapolating information from various sources, I just don’t see a usable product getting released before 2010 or 2011.

Wow. That was mind-blowing. If Project Green is a train wreck, that has massive implications for both customers and partners. For me, I couldn’t wait six more years for modern financial modules – I’d be out of business. Were Axapta customers going to continue paying hefty maintenance fees for six more years without an update? Axapta resellers would be forced to take on competing ERP products to survive. The competition was going to have a field day.

Unsurprisingly, the steady bad news continued to flow from Microsoft. Dates continue to slip, to Q1 2006 and then to Q4 2006.

2006: Everything is “fine”

By the end of 2006, Microsoft could no longer hide the fact that Project Green was still at least five years away. Both the user base and reseller channels were now in open revolt. They’ve effectively wasted three years without a single product upgrade, and customers needed to wait another five years?

A reminder. These products were elderly back in 2003, and it’s now 2006. Competitors are leapfrogging Microsoft by incorporating new technology and steadily releasing significant enhancements. Microsoft’s market position is slipping away.

Coincidently, Microsoft stopped breaking out separate financials for the ERP group in 2006. The numbers were buried inside the massive Business Division, which includes Microsoft Office. The ERP executives start to publish mysterious and non-GAAP metrics like “percentage increase in billings.” These moves made it difficult to tell what was going on with the ERP products- were they losing even more money this year? Were opaque numbers being used to obscure unfavourable business results?

Microsoft continues to add complexity and integration with other Microsoft products. Office now connects to Dynamics, which connects to server technologies like Exchange, SQL Server, and Biztalk. They proudly show off a slide deck that illustrates how 25 different servers and other numerous moving parts now form the convoluted tech stack for Dynamics.

This increasing product and technical complexity will continue for years to come. Customers begin to rack up huge billable hours from system integrators and Microsoft support to make the tech stack function.

2007 – Pulling the plug on Project Green

By 2007, Project Green was on a ventilator. Sales of Microsoft’s ERP products are drying up. No one wants to invest in an obsolete solution. The industry buzz has tapered down to zero. There are several high-level management departures in the ERP department. Morale is sinking.

Microsoft rushed out a minor release: Axapta version 4.0. This version bolted on some minor web capabilities and followed the recurring theme of integration to other Microsoft products, in this case, BizTalk Server.

There was severe disappointment that the aging X++ would not be replaced. Microsoft released some hazy statements on the upgrade path from Axapta 4.0 to Project Green that made customers and resellers anxious:

“Some things will be an upgrade, some things will be a migration, some things will be a conversion,” said Dave Coulombe, general manager of MBS Fargo, ND, Development Center. “There will be varying degrees of pain.”

In late 2007, after four years of confusion, massive spending, and missed targets, the plug is finally pulled on Project Green. Microsoft reportedly wrote off over $500 million. They pivoted to a new strategy and announced individual upgrades for Axapta and each of their other ERP products.

The grand vision of market domination was finished. The Microsoft development team announced a 2009 release date. Customers and resellers grumbled over another two-year wait.

After owning Axapta for five years, Microsoft had only managed to squeeze out two minor updates.

Microsoft ends the year with $23 billion of cash on hand and a 31% return on equity.

2009 – The Hamster Wheel and the Locomotive: The release of Dynamics AX 2009

Microsoft backtracks and now commits to upgrading Dynamics AX. They release Dynamics 2009.

“What we found in talking to our partners and customers is they really don’t want revolution; they want evolution. We are 100 percent committed to all four of our products in our portfolio.”

Kirill Tatarinov

VP of Microsoft MBS, 2009

This version includes several country-specific and functional enhancements. At long last, Axapta finally catches up to the competition with support for 64 Bit SQL Server. They also add support for Active Directory, export to Excel, SQL Server Reporting Integration, and Integration to Microsoft Office Communicator. Microsoft continues to put much more effort into selling customers more addon products than addressing the growing functionality and performance issues.

At this point, the X++ framework is the technical equivalent of a hamster wheel. The response times and processing power of AX were becoming more and more of a bottleneck. There are widespread complaints from customers. Although AX data does reside in a SQL Server database, it still did a majority of its data processing using X++. If using X++ can be equated to the power of a hamster wheel, think of SQL server’s power as comparable to a locomotive. So, customers were paying for a “locomotive” but the product did not use its capabilities and opted to use the hamster wheel instead.

Microsoft slapped on all kinds of band-aids like complex batch processing, load balancers, and multiple data caches to address the sluggish performance. On the functionality side, AX still lacked even modest shop floor tracking capabilities and warehouse management. Plus, the costing capabilities were rudimentary.

Recap: Microsoft continues to put much more effort into selling customers more addon products than addressing functionally and performance issues.

Microsoft had now owned the product for seven years and haven’t released anything of significance. The architecture continued to age, and the user and reseller base were fuming over the lack of upgrades. There is tremendous market pressure on the Microsoft team to deliver something.

Microsoft does have the financial resources to upgrade the product, so why aren’t they? Microsoft ends the year with $31 billion of cash on hand and an eye-popping 49% return on equity.

2012 – Muddying the Waters: The release of Dynamics AX 2012

Microsoft releases Dynamics AX 2012. This release introduced the Office Ribbon to most forms and continued to include integration to even more Microsoft products, all to extract more cash from their customers. This release continued with the enhancements for country-specific and functional areas.

However, the X++ hamster wheel, the complexity, the batches, and all the performance problems were all still there.

On top of that, this version came with a new licensing and pricing system. Licensing was now a confusing array of Servers, User Types, Business Roles, and many other elements. Complex spreadsheets were required to compare the hundreds of upgrade paths available to convert existing AX 2009 licenses to the new AX 2012 licenses.

Then customers still had to manage contracts with AX product addon vendors, customizations, and reseller support agreements. Whew.

And customers aren’t done yet. The next maze to tackle was the three payment channel options:

- Enterprise Agreement – directly with Microsoft

- Business Value Licensing through a Reseller

- Services Provider License Agreement – though a hosting company

These channels made it even more difficult to figure out which program provided the best fit. AX customers had to factor in things like: renewals, subscriptions, training, failover rights, fixes, updates, and sales tax releases. Once you’ve made it through licensing and contracts, managing compliance is your responsibility, and its not a simple task.

Microsoft has now owned Axapta for a decade, and what they have released is light years away from the aspirations of Project Green. Are you getting the impression that Microsoft continues to put a lot more effort into monetization than it does provide value-added services for AX customers?

Microsoft ends the year with $63 billion of cash on hand and a 41% return on equity.

2017 – The Death of Dynamics AX

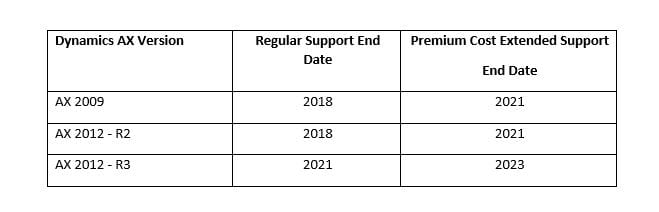

Microsoft announced the death of the Dynamics AX product. They set the end of support dates for Dynamics AX:

- Version AX 2009 – 2018

- Version AX 2012 – 2021

What year did you buy Axapta?

Conclusion: The uncertain future

Let’s recap: If you bought AX 2009 in 2009, you would have received a maximum of one upgrade in the decade you owned it.

Microsoft Dynamics has now owned Axapta for 15 years. The dismal track record over this period has produced:

- Only two significant version releases (2009 & 2012)

- Increased licensing and billing complexity immensely

- Failed to update the technology platform – not updating the ancient technical framework of X++

- Left AX users stranded without a viable and affordable upgrade path

If you are fortunate enough to be a Microsoft shareholder, you can jump for joy. Their strategy has produced outsized financial results. They finished off 2017 with $132 billion of cash on hand and an attractive 40% return on shareholders’ equity.

If you’re an Axapta customer– you’ve been left in a difficult position, having spent hundreds of thousands customizing your solution to overcome functional holes in the core product. You’ve also likely spent a lot of time and money dealing with sluggish performance issues that Microsoft should have addressed long ago. You’ve had to jump through pricing and licensing hoops, and now they expect you to spend another boatload of cash and make the jump to the new Dynamics product.

I don’t believe Microsoft killed AX in bad faith. I think it is more of a case of an inevitable outcome of several factors: constant management turnover, aggressive financial targets, and a complex, globally distributed organization chart. Killing the product was a business decision to generate higher returns for shareholders.

Microsoft could have made other decisions – they could have invested in improving the AX product. They could have reduced their return on equity below 40% and deployed some tiny portion of their $132 billion pile of cash. They could have helped their AX customers get more a lot more value from their product. Unfortunately, that’s not how they did it, and now AX customers are up the creek without a paddle.

Next in this series, I’ll do a deep dive into the new product: Dynamics 365 Finance & Operations. Can Microsoft stick the landing on the new product? Can they course correct and deliver viable upgrade options for the AX user base? Or will Microsoft Dynamics 365 incorporate even more complexity and more ways for them to make money? Stay tuned to find out!

Coming up Next:

- Will D365 F&O work for you?

- The Microsoft ERP Ecosystem: No One’s Accountable for your Success

- Seradex – The 7 Key Reasons we Beat D365 F&O

For more information, or for questions or concerns, please contact email us at info@seradex.com

The views and opinions expressed in this blog are those of the authors and do not necessarily reflect the official policy or position of Seradex as a whole.