|

In order to properly map taxes from your accounting system while Updating Accounting Information (see Update Accounting Information) the Appropriate Tax Group Match must be Setup. Each Accounting system Seradex supports has a certain way the taxes have to be set-up.

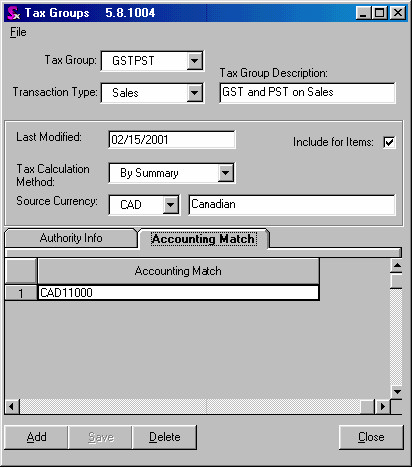

The Accounting match form is accessed by clicking on the [Utilities] bar, followed by the [Taxes Set-up] and then Tax group icon within the Active.ERP profile, and looks as shown below.

ACCPAC 4.1 or Greater

The Tax Group Match is a concatenation of Tax Group and the five Status fields.

Important: In Order For Day End to Function Properly, Certain Rules must be followed for the tax setup in Seradex. They are outlined below. And you should Run Update Accounts when this is done with the Update All Option Turned on – See Advanced Options of Update Accounts

You must have the same authority names in Seradex as ACCPAC, this can not be compromised with. And you must have 1 Seradex tax group for every ACCPAC Tax Group and Status Combination.

Example

A customer has the following ACCPAC Tax information: (This is a view of the ACCPAC TXGRP table)

|

|

|

|

|

|

|

|

|

CAD

|

1

|

CAD

|

GST

|

PST

|

|

|

|

CADTAX

|

2

|

CAD

|

GST

|

|

|

|

|

USD

|

1

|

USD

|

GSTUSD

|

PSTUSD

|

|

|

|

USDTAX

|

2

|

USD

|

GSTUSD

|

|

|

|

|

Therefore this client requires 4 Authorities in Seradex, GST, PST, GSTUSD, PSTUSD

This client also has three variations for each group of statuses against customers.

|

|

|

|

|

|

|

CAD

|

1

|

1

|

0

|

0

|

0

|

CAD

|

1

|

2

|

0

|

0

|

0

|

CAD

|

2

|

2

|

0

|

0

|

0

|

USD

|

1

|

1

|

0

|

0

|

0

|

USD

|

1

|

2

|

0

|

0

|

0

|

USD

|

2

|

2

|

0

|

0

|

0

|

So you need one sales Tax Group for each variation. For example, the accounting matches would be if you were to name the tax groups in Seradex this way, you can name them what ever you want.

GSTPST = CAD11000

GSTOnly = CAD12000

ExemptCDN = CAD22000

GSTPSTUS = USD11000

GSTonlyUS = USD12000

ExemptUS = USD22000

Business Vision 7

The Accounting Match is always a three-digit number that represents a concatenation of the three BV status fields. This is a typical example

120 – GSTPST

100 – GSTonly

000 – Exempt

Great Plains

In Great Plains Sales Taxes require the setup of Tax Schedules and Tax Details. Once the Tax Schedules and Tax Details are setup in Great Plains then the Seradex Project Manager can synchronize Tax Authorities, Tax Groups and Tax Rules to match this setup.

The Tax Schedule in Great Plains is analogous to the Tax Group in Seradex. The Tax Details are analogous to the Tax Rules in Seradex.

In Seradex Sales Taxes are calculated on the Bill to Tax Group unless there is a Tax Group assigned to the Ship to Address. Tax information can be overridden on a line item basis on both Sales Orders and Purchase Orders.

|