|

To create a bank reconciliation per GL account, please do the following:

| 1. | Open the Bank Reconciliation screen by selecting “Banking” >> “Bank Reconciliation” |

| 2. | Press the add button on the bottom right of the screen. Note: only one active Bank Reconciliation per bank account is allowed. You must fully complete bank reconciliation before you are allowed to create a new one. |

| 3. | Choose the Bank GL Account that you would like to reconcile. |

| 4. | The screen will now load showing you the opening balance based on the last reconciled date and will match your opening balance on your bank statement. |

Example

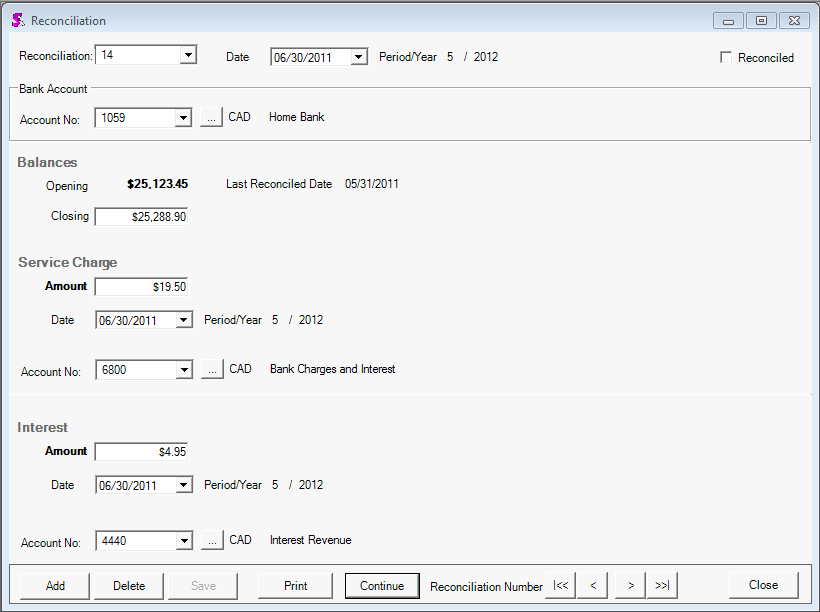

The statement is dated June 25th and the balance as of the May statement was $25,123.45 and the closing balance of the June statement is $25,288.90

The statement shows a service charge of 19.50 and interest earned of $4.95.

| 5. | Even though the bank statement may not be dated the last day of the fiscal period it is best to set the bank statement date to the last day of the fiscal period the statement falls under. This will allow the bank reconciliation report to easily tie in to the Trial Balance at the end of the period. The system defaults to the last day of the period for convenience. |

| a. | Closing Balance as per the statement |

| i. | If you incurred service charges, the total amount can be entered. You can then specify the GL Account that you would like to credit for this transaction. |

| ii. | You can also specify the date that the service charge was recorded on as per the bank statement. |

| i. | If you collected interest on the account in question, you can record the amount of the interest. |

| ii. | You can also specify the GL that should be credited for the transaction. |

| 7. | Once the main details are filled in, press the save button. |

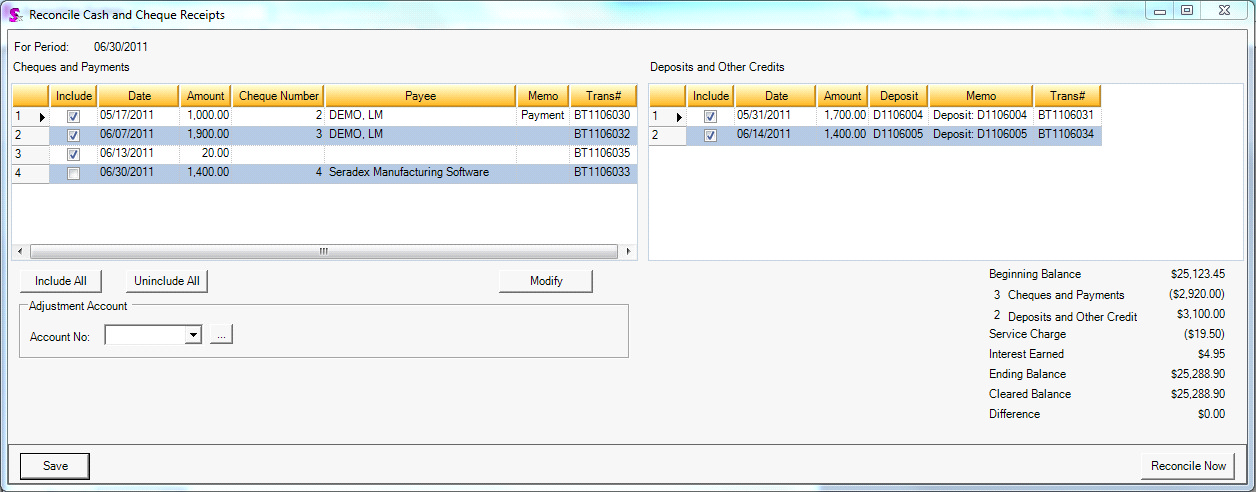

| 8. | Doing this will now activate the continue button. Pressing this button will show you a new screen where the left side represents the list of cheques and payments that have not been reconciled. Whereas, the right side will show you all the deposits and credits to be reconciled. |

The following Payments were recorded in the system that has not cleared as of the last statement that is recorded in your GL as of the reconciliation date.

Payment includes Bank Withdrawals, Cheques, Payments, and Transfers to a bank account from another account.

Example

The following Payments have been recorded in the accounting system that have not cleared yet as per the last statement.

The following deposits were recorded

Deposits include Entries from the Deposit module and Bank Transfers from another bank account.

The bank statement shows all above have been cleared except the payment dated June 30th for 1,900

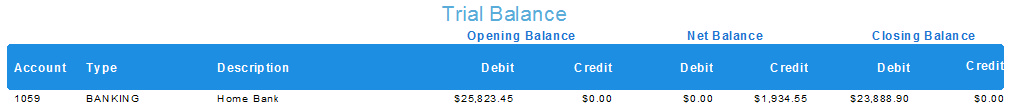

Please note, the trial balance will not include deposits that have not been posted. And Service charges and interest entered on the reconciliation form itself will not be reflected on the trial balance until it is completed. The user can enter these items as bank transactions and simply include them if desired but is not required.

| a. | The left side of the screen shows all open cheques and payments that have not be reconciled. Only transactions dated up to the statement date are shown. |

| b. | Left click on the items to include them in the batch to be reconciled. |

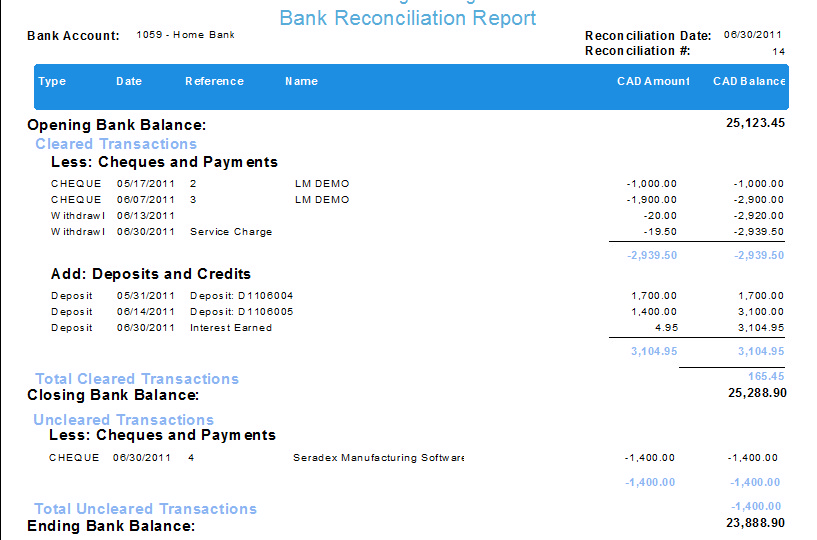

| 10. | Please note the reconcile now button is what actually completes the reconciliation. Any service charge, interest and adjustments will be recorded in the Trial Balance at the specified dates. Also every reconciled bank transaction will be posted if not done so already. Cheques, Payments, Withdrawals and transfers cannot be posted manually by users. Only the reconciliation module can do this. |

| 11. | Once reconciled the Trial balance as of the reconciliation date will match the closing balance plus open reconciliation items. This is known as the book balance and does not always match the bank balance. |

The reconciliation report after processing will tie in.

|